Decoding Wage and Hour Laws: Your Essential Guide

Navigating the intricacies of wage and hour laws is a critical aspect of employment for both employers and employees alike. This comprehensive guide aims to unravel the complexities surrounding these laws, providing essential insights to ensure fair and legal practices in the workplace.

Understanding the Basics: Wage and Hour Laws Overview

Wage and hour laws encompass regulations that govern the compensation employees receive for their work and the number of hours they work. These laws set the groundwork for minimum wage, overtime pay, recordkeeping, and other crucial aspects of the employer-employee relationship.

Minimum Wage Requirements: Ensuring a Fair Compensation Base

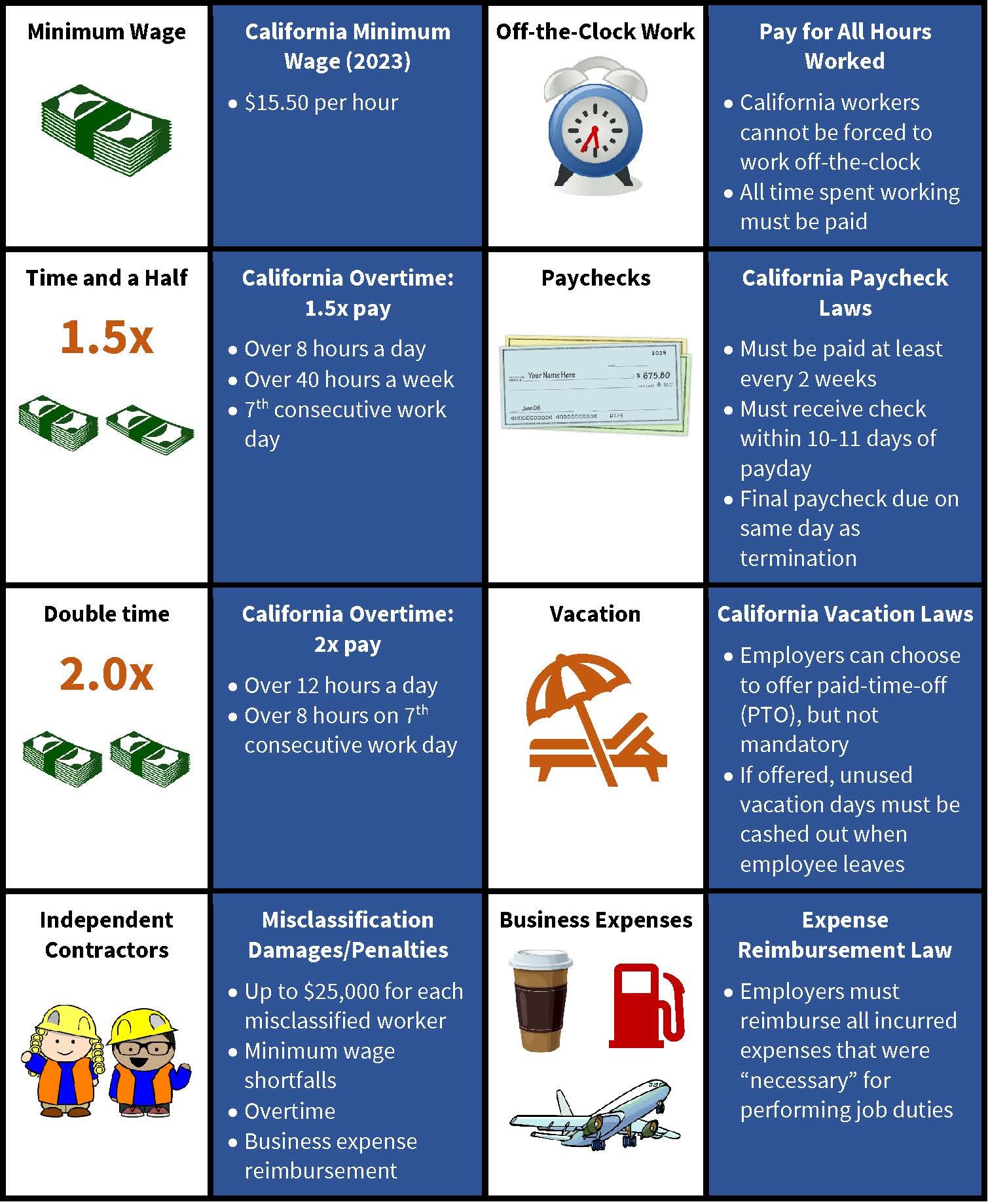

One of the fundamental components of wage and hour laws is the determination of minimum wage. Employers must comply with federal and state minimum wage requirements, ensuring that employees receive a fair compensation base for their labor. Understanding the specific rates applicable in your jurisdiction is essential.

Overtime Pay Regulations: Compensating Extra Effort

Wage and hour laws address the issue of overtime pay for employees who work beyond standard working hours. Understanding the criteria for overtime eligibility and the calculation of overtime pay is crucial for employers to ensure they compensate their employees fairly for their extra effort.

Exempt vs. Non-Exempt Classification: Navigating Employee Status

Employees are typically classified as exempt or non-exempt based on criteria such as job duties, salary level, and more. This classification determines whether employees are eligible for overtime pay. Ensuring accurate classification is vital to compliance with wage and hour laws.

Recordkeeping Obligations: Maintaining Transparent Employment Practices

Wage and hour laws impose recordkeeping obligations on employers. This includes maintaining accurate records of hours worked, wages paid, and other relevant information. Transparent recordkeeping not only ensures compliance but also serves as a valuable resource in the event of audits or legal disputes.

Meal and Rest Breaks: Balancing Work and Well-being

Some jurisdictions have specific regulations regarding meal and rest breaks for employees. Wage and hour laws may require employers to provide designated breaks during working hours. Complying with these regulations is crucial for fostering a healthy work-life balance and avoiding legal issues.

Child Labor Laws: Safeguarding Young Workers

Wage and hour laws also address child labor, setting restrictions on the types of work, hours, and conditions for young workers. Employers must be aware of and adhere to these regulations to ensure the well-being and safety of underage employees.

Enforcement Mechanisms: Government Agencies and Legal Actions

Wage and hour laws are enforced through government agencies such as the Department of Labor (DOL). Employees also have the right to take legal action against employers for wage and hour violations. Understanding these enforcement mechanisms is crucial for both employers and employees.

Wage and Hour Laws and Your Business: Navigating Compliance Challenges

For businesses navigating the complexities of wage and hour laws, expert guidance is invaluable. Visit josslawlegal.my.id for tailored insights and legal support. Our experts specialize in decoding the intricacies of wage and hour laws, ensuring your business remains compliant with the latest regulations.

Staying Informed: A Continuous Endeavor

Decoding wage and hour laws is an ongoing process. Regular updates, legal counsel, and proactive measures are essential for businesses and employees alike. By staying informed and taking the necessary steps, employers can create a fair and legally sound working environment.