Untangling the Web: Taxation of Trusts Unveiled

Delving into the intricate realm of taxation, the focus turns to an often nuanced subject – the taxation of trusts. Beyond the surface-level understanding, the taxation landscape for trusts involves complexities that demand attention. Let’s peel back the layers and gain insights into the financial strategies surrounding trusts.

The Basics: Trusts in the Taxation Spotlight

At its core, a trust is a legal entity that holds assets for the benefit of specified individuals or entities. When it comes to taxation, trusts are not immune to scrutiny. The Taxation of Trusts places them under the financial microscope, requiring a clear understanding of how income generated within trusts is treated under tax laws.

Types of Trusts: Diverse Structures, Diverse Tax Implications

Trusts come in various forms, each with its own set of tax implications. From revocable living trusts to irrevocable trusts and charitable trusts, the choice of trust structure significantly influences the taxation landscape. Determining the most tax-efficient structure requires careful consideration of individual circumstances and financial goals.

Taxation of Trust Income: Unraveling the Complexities

One of the central aspects of the Taxation of Trusts revolves around the income generated within the trust. Trust income can take various forms, including interest, dividends, capital gains, and rental income. Understanding how these income streams are taxed, and the rates applicable, is crucial for effective tax planning within the trust framework.

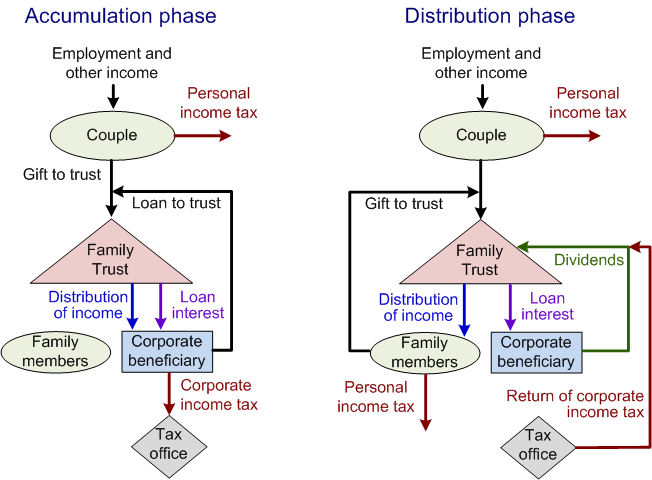

Distributions and Beneficiaries: Impact on Tax Liability

The distribution of income to beneficiaries from a trust is a pivotal point in the Taxation of Trusts. How and when income is distributed can have significant tax consequences. Trustees must navigate the rules surrounding distributions to minimize tax liability for both the trust and its beneficiaries.

Tax Credits and Deductions: Leveraging Financial Strategies

Just like individuals and businesses, trusts may be eligible for certain tax credits and deductions. Whether it’s educational expenses, charitable contributions, or specific deductions applicable to trusts, leveraging these financial strategies can optimize the Taxation of Trusts. Professional advice becomes invaluable in identifying and capitalizing on available tax incentives.

Estate Tax Considerations: Planning for the Long Term

In the realm of trusts, estate tax considerations play a crucial role. The Taxation of Trusts intersects with estate tax laws, impacting the transfer of wealth to heirs. Establishing trusts as part of an overall estate plan involves careful consideration of how taxation dynamics will shape the ultimate distribution of assets.

State vs. Federal Taxation: Navigating Dual Jurisdictions

The Taxation of Trusts operates within both state and federal jurisdictions, each with its own set of rules. Navigating the dual taxation landscape requires a comprehensive understanding of the interplay between state and federal tax laws. Trust structures and distribution strategies may vary based on the specific tax regulations in play.

Changes in Tax Laws: Adapting to Legislative Shifts

Tax laws are not static, and the Taxation of Trusts is subject to legislative changes. Staying abreast of amendments and updates is crucial for trustees and beneficiaries alike. Adapting trust structures and financial strategies to align with the evolving legal landscape is a proactive approach to managing tax implications.

Professional Guidance: A Trustee’s Best Ally

Given the intricate nature of the Taxation of Trusts, seeking professional guidance is not just advisable – it’s paramount. Trustees, beneficiaries, and those considering the establishment of trusts can benefit immensely from the expertise of tax professionals and legal advisors. Professional insight ensures compliance with tax laws and maximizes the financial advantages of trust structures.

For In-Depth Insights, Visit Taxation of Trusts at josslawlegal.my.id

For those eager to delve deeper into the Taxation of Trusts and explore expert insights, a valuable resource awaits at josslawlegal.my.id. Uncover the nuances, legal strategies, and financial considerations surrounding trusts. Understanding the taxation intricacies is not just a matter of compliance – it’s a key to navigating the financial landscape with precision and foresight.