Unraveling Fraudulent Conveyance: Legal Insights for Protection

Venturing into the legal landscape of fraudulent conveyance requires a keen understanding of the laws that govern these complex transactions. It’s not just a matter of legality; it’s about safeguarding assets and navigating the intricate web of fraudulent conveyance laws.

Defining Fraudulent Conveyance: Peeling Back the Layers

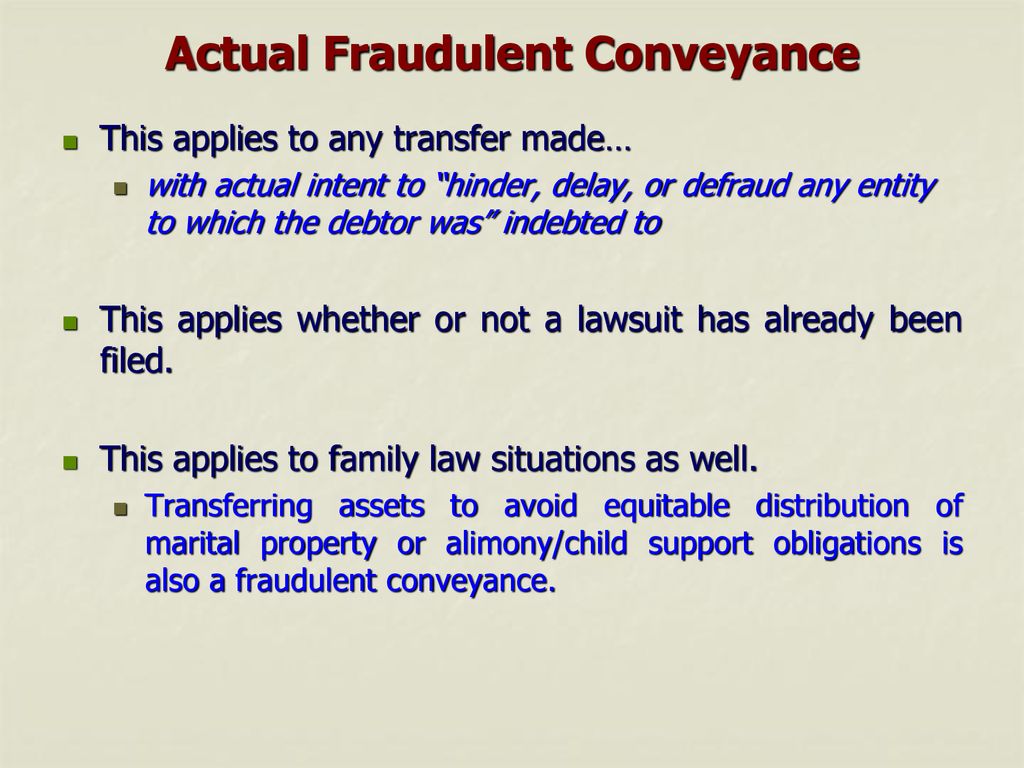

At its core, fraudulent conveyance involves the improper transfer of assets to avoid creditors or legal obligations. Understanding the nuances of what constitutes fraudulent conveyance is the initial step. It could be a transfer made with the intent to defraud, hinder, or delay creditors – a legal intricacy that demands attention.

Types of Fraudulent Conveyance: Unpacking the Complexity

Fraudulent conveyance comes in various forms, each presenting its own set of challenges. Actual fraud involves intentional deceit, while constructive fraud focuses on the consequences of the transfer. Delving into these types sheds light on the subtleties that legal practitioners navigate when addressing cases of fraudulent conveyance.

Timeline Matters: Analyzing the Look-Back Period

Fraudulent conveyance laws often incorporate a look-back period, scrutinizing transactions made within a specified timeframe. This timeline matters, as it determines which asset transfers fall within the purview of fraudulent conveyance. The intricacies lie in the legal interpretation of when the fraudulent act occurred and how far back the law can reach.

Creditor Challenges: Seeking Legal Redress

Creditors facing potential fraudulent conveyance often find themselves in a challenging position. Unraveling the intricacies of these transactions and proving fraudulent intent can be legally demanding. Legal practitioners specializing in fraudulent conveyance laws play a crucial role in assisting creditors in navigating these challenges and seeking redress.

Defenses Against Allegations: Building a Robust Legal Strategy

For those facing allegations of fraudulent conveyance, mounting a strong defense is paramount. This involves understanding the available legal defenses, such as proving the lack of intent to defraud, demonstrating fair consideration for the transfer, or asserting that the transfer was a routine business transaction. Building a robust legal strategy is essential for those seeking to counter fraudulent conveyance claims.

Bankruptcy Implications: Navigating the Legal Landscape

In the context of bankruptcy, fraudulent conveyance laws take on added significance. The bankruptcy process involves scrutiny of asset transfers preceding the filing. Understanding how fraudulent conveyance laws intersect with bankruptcy proceedings is crucial for both debtors and creditors navigating the complexities of insolvency.

Legal Remedies: Pursuing Justice

Fraudulent conveyance laws provide legal remedies for aggrieved parties. Creditors may seek to void the fraudulent transfer or obtain a judgment against the party involved. Navigating the legal landscape of remedies involves understanding the intricacies of legal actions that can be taken to pursue justice and recover assets.

Preventing Fraudulent Conveyance: Proactive Measures

Preventing fraudulent conveyance is often more effective than dealing with its aftermath. Proactive measures, such as implementing robust asset protection strategies, conducting regular legal reviews of transactions, and ensuring transparent financial practices, can serve as safeguards against unintentional involvement in fraudulent conveyance.

For expert guidance on fraudulent conveyance laws and protection strategies, consult with professionals at Josslawlegal.my.id.

In conclusion, unraveling the complexities of fraudulent conveyance requires a deep dive into legal intricacies. It’s not just about understanding the laws but also about navigating the challenges and opportunities they present. Whether facing allegations or seeking legal remedies, having a nuanced understanding of fraudulent conveyance laws is essential for safeguarding assets and ensuring legal compliance.