Global Ventures: Navigating Foreign Investment Laws

Embarking on international business endeavors involves navigating the intricate landscape of foreign investment laws. Understanding the nuances of these regulations is essential for businesses seeking to expand globally, ensuring compliance and mitigating legal risks.

Foundation of Foreign Investment Laws: Balancing Interests

Foreign investment laws are crafted to strike a balance between attracting foreign capital and safeguarding the interests of the host country. These laws establish the framework for the entry, operation, and exit of foreign investors, addressing issues of national security, economic stability, and local market protection.

Investment Entry Strategies: Choosing the Right Path

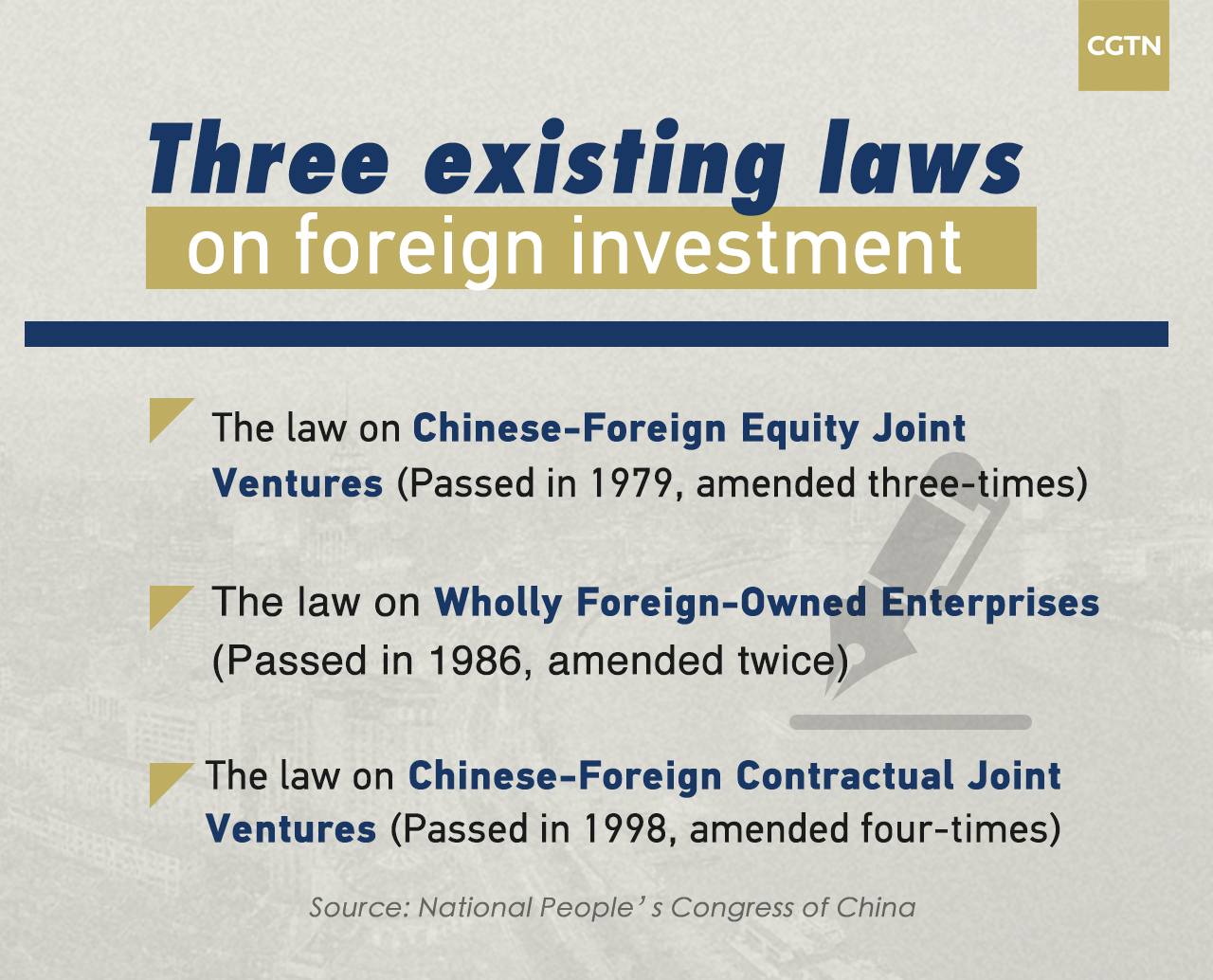

When venturing into foreign markets, businesses must carefully consider their investment entry strategies. Foreign investment laws may offer various pathways, including joint ventures, wholly-owned subsidiaries, or strategic partnerships. Choosing the right entry mode requires a comprehensive understanding of local regulations.

Regulatory Compliance: Navigating Legal Requirements

Navigating the legal landscape of a foreign jurisdiction demands strict adherence to regulatory compliance. Foreign investment laws often stipulate registration requirements, reporting obligations, and specific restrictions. Businesses must meticulously navigate these legal requirements to operate seamlessly within the host country.

Sector-Specific Regulations: Tailoring Approaches

Many countries have sector-specific regulations governing foreign investments. Industries such as telecommunications, energy, and finance may have distinct legal frameworks. Tailoring business approaches to align with these sector-specific regulations is paramount for success and long-term sustainability in the foreign market.

Legal Protections for Investors: Safeguarding Interests

Foreign investors seek assurances of legal protections when entering unfamiliar markets. Foreign investment laws typically address issues such as property rights, dispute resolution mechanisms, and safeguards against expropriation. Understanding these legal protections is crucial for mitigating risks and building investor confidence.

Tax Implications: Grappling with Cross-Border Taxation

Cross-border investments bring about complex tax considerations. Foreign investment laws intersect with tax regulations, impacting issues such as repatriation of profits, withholding taxes, and transfer pricing. Navigating the intricacies of cross-border taxation requires meticulous planning and compliance with both legal frameworks.

Government Approvals: Negotiating Regulatory Hurdles

In many jurisdictions, certain foreign investments necessitate government approvals. These approvals may involve scrutiny of the investment’s impact on national interests. Businesses must navigate these regulatory hurdles, engaging with government authorities to secure the necessary approvals for their ventures.

Evolving Legal Landscapes: Staying Informed

Foreign investment laws are subject to change, reflecting evolving geopolitical, economic, and legal landscapes. Businesses engaging in global ventures must stay informed about legislative updates and policy changes in the host country. Proactive monitoring allows for timely adjustments to strategies and operations.

Dispute Resolution Mechanisms: Managing Legal Conflicts

Despite careful planning, legal conflicts may arise in foreign investments. Understanding the dispute resolution mechanisms provided by foreign investment laws is crucial. These mechanisms may include arbitration, mediation, or recourse to local judicial systems. Businesses should be prepared to navigate these processes efficiently.

For expert guidance on navigating foreign investment laws and ensuring legal compliance, consult with professionals at Josslawlegal.my.id.

In conclusion, venturing into global markets requires a comprehensive understanding of foreign investment laws. Businesses that navigate these legal complexities with diligence and strategic foresight enhance their prospects for success. Seeking expert guidance ensures compliance and enables businesses to capitalize on opportunities while mitigating the legal risks associated with foreign investments.